How Can I Buy A House For The First Time With A Little Bit Of Money Down Payment

Buying a abode is more accessible than many people think.

Gone are the days of needing tens of thousands of dollars to become a homeowner. Today, you lot don't need a 20 per centum down payment to buy a abode. In fact, there are no-coin-downwards mortgages bachelor to you correct at present.

If you're wondering how to buy a business firm with no money down, continue reading to showtime your journey to homeownership.

30-eight per centum of prospective buyers say that saving for a down payment is their biggest obstruction to homeownership. Considering the median domicile sale price of $356,700, the average first-time heir-apparent would spend $24,969 on a downward payment.

But you can purchase a firm without that $25,000.

There are resource for downwards payment aid that provide a clear path to homeownership. Current legislation awaiting a vote in Congress would offering $15,000 taxation credits and $25,000 grants to outset-fourth dimension buyers.

Ameliorate all the same, if you're wondering if now is a good time to purchase a business firm with no money downwardly, you lot don't accept to wait for new federal legislation. Here's how you can purchase a house with no coin down today.

How To Buy a House With No Coin Down

If you could live in your dream home for zero dollars downwards, would you still choose to rent?

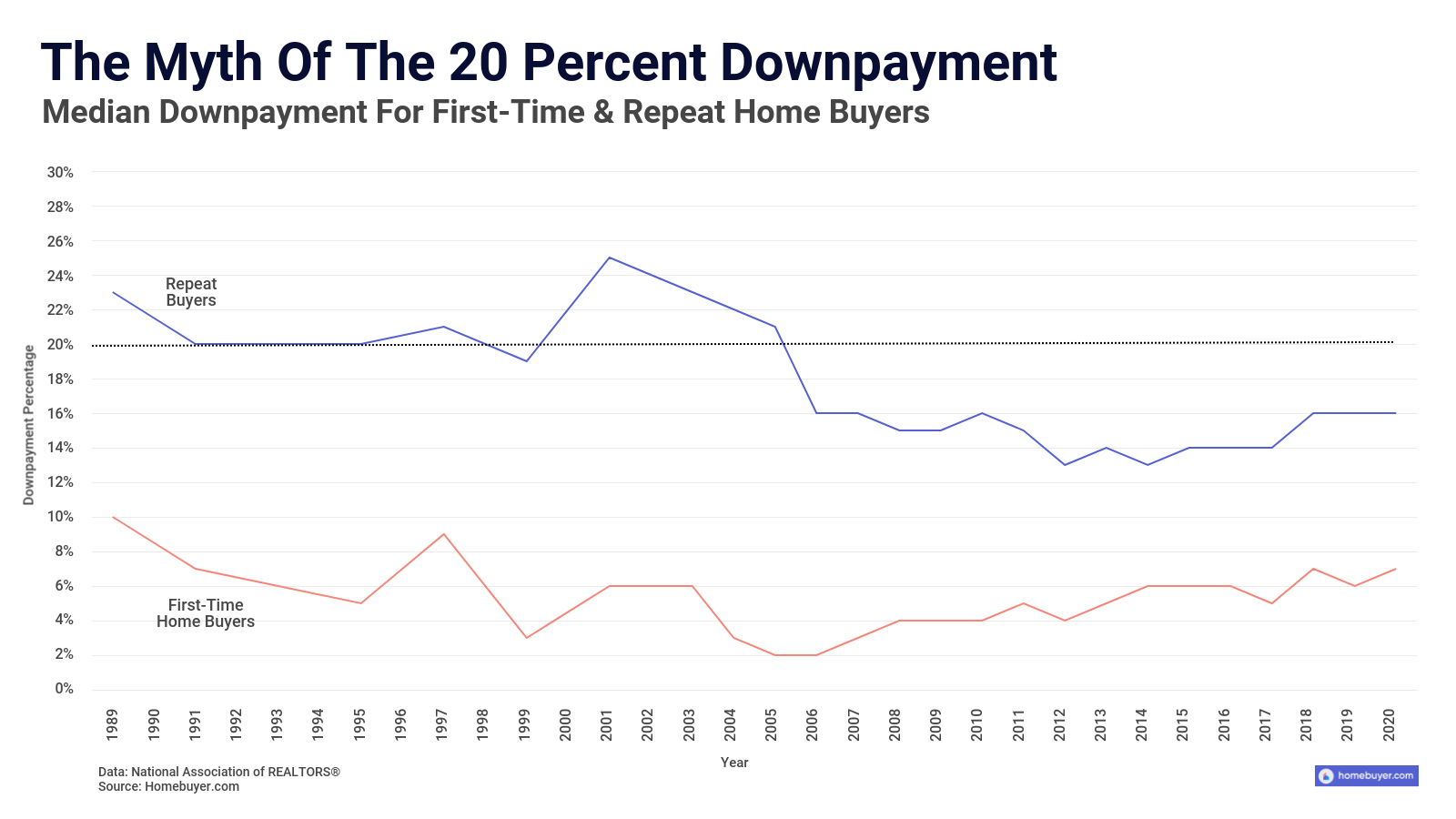

You lot don't need a huge downwardly payment to buy a home. Start-time buyers put down an boilerplate of vii%. The chart beneath highlights the median downpayment for first-time buyers since 1989 based on information from the National Association of Realtors (NAR).

Only what about endmost costs?

There'due south also down payment assistance available to assistance yous get a mortgage with no coin out of pocket. Federal, state, and non-turn a profit agencies — and fifty-fifty mortgage lenders — offering grants and loans to support first-fourth dimension buyers.

Let's take a expect.

ane. Homebuyer Down Payment Aid

Down payment assistance (DPA) tin can aid you buy a habitation without immediate cash. This includes several federal, state, and non-profit programs for offset-time abode buyers.

At Homebuyer, we partner with the Chenoa Fund to make homeownership possible without paying annihilation out of pocket.

Through our partnerships, Homebuyer.com provides DPA for buyers purchasing a abode with an FHA loan, offering an affordable and user-friendly path to homeownership.

Buyers accept two choices — a 3.5 percent second loan to cover your downward payment, or a 5 percentage 2d loan to comprehend down payment and endmost costs.

If you lot're a middle-income earner, or lower, the 2nd loan has zero interest and no monthly payments. Plus, information technology'south a forgivable 2d mortgage. If you make your housing payments on time, the loan is forgiven and you lot never have to pay it back.

The 3.v pct pick is forgiven afterwards you lot brand your first 36 mortgage payments on time.

The 5 percent option is forgiven afterward y'all make 10 years of payments without falling 60 or more days behind. If you practise fall backside, in that location is all the same no interest and no payments — you'll just have to pay back the 2d lien when you sell or refinance the house.

If you're a higher-income earner, the second loan has a monthly payment. Buyers can choose a 10-year loan with no involvement, or a 30-year loan with 5 percent involvement.

Down payment aid programs typically accept credit history and income requirements. Programs for get-go-time home buyers may require completion of a mortgage education course.

These down payment assistance options are available now and y'all can apply by getting pre-approved.

Learn more than about downwardly payment assistance.

2. USDA Loans With No Coin Downwardly

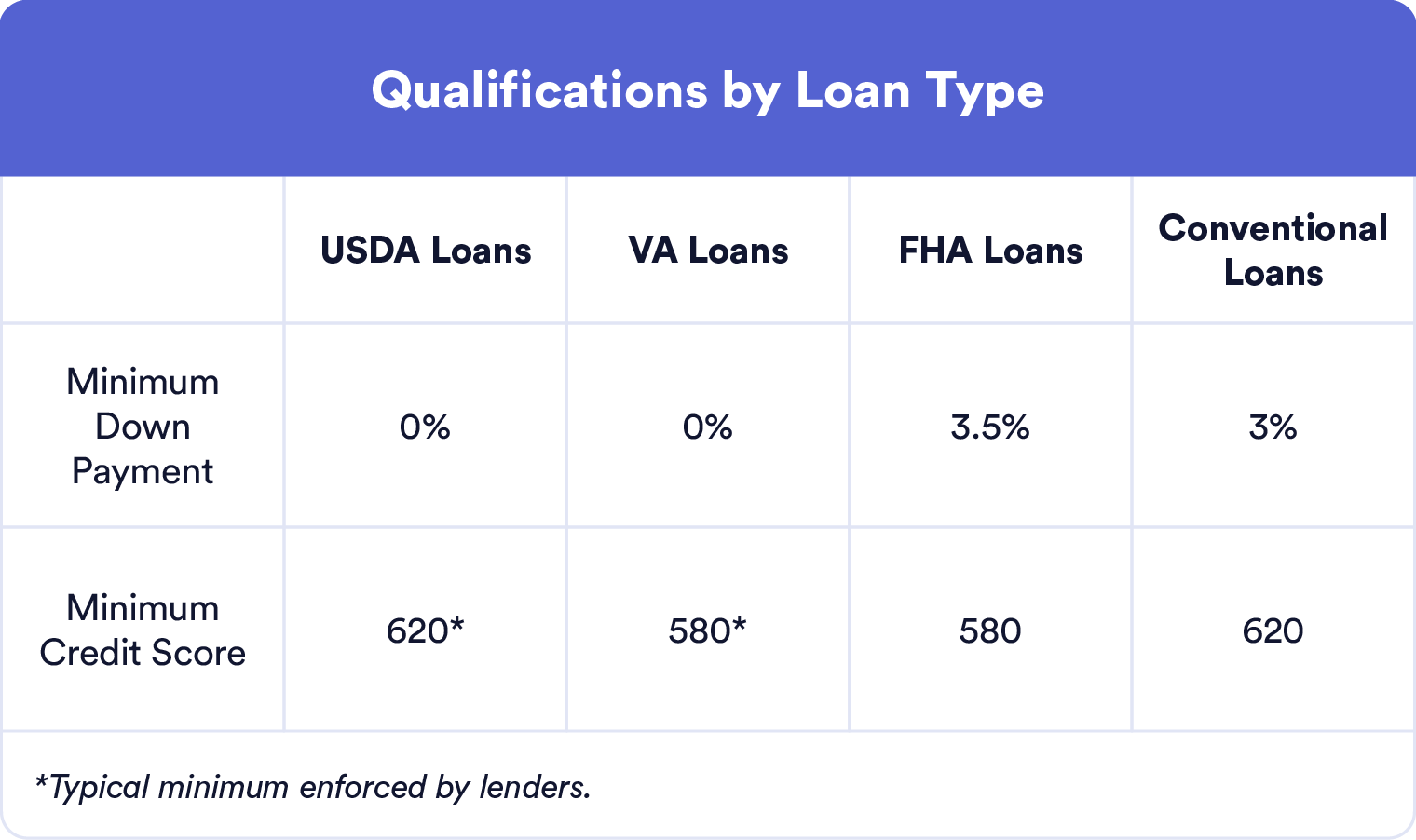

USDA loans take no down payment requirements or credit score minimums. Designed to encourage increased homeownership in rural areas, these loans provide subsidized interest rates.

Applicants must testify creditworthiness. Lenders typically require a credit score of 620 or higher to apply.

USDA loan applicants must:

- Be a legal permanent U.Southward. resident

- Prove creditworthiness

- Maintain dependable income

- Take a household income matching 115 percent of the area's median income or lower

- Be the chief residence in a rural area

USDA mortgages can be used to purchase these property types:

- Existing home

- New structure

- Manufactured homes

- Condos

- Townhouses

- Short sale or foreclosed homes

Buyers are typically responsible for endmost costs, lender fees, and mortgage insurance, though at that place are opportunities to have some of these expenses covered past the seller or your lender.

Yous can receive seller concessions and lender credits, where the seller and lender will pay some, or all, of your closing costs.

3. VA Abode Loans With No Down Payment

VA loans provide home-buying options for U.S. military members, veterans, and their spouses. Like USDA loans, VA loans have no down payment or credit score requirements, though nearly lenders prefer a credit score of 580 or higher.

You must have a certificate of eligibility (COE) to apply for a VA loan. This certifies your service history and electric current duty status to prove you're eligible.

VA eligibility requires:

- You served xc days of active wartime service

- You lot served 180 days of active peacetime service

- Yous served half-dozen years in the National Baby-sit or Reserves

- You lot're the spouse of a service fellow member who died in the line of duty or following a service-related disability

The VA guarantees loans against losses with an entitlement, which is similar to private mortgage insurance. This allows lenders to offer a zero-downwardly payment buy with less chance and lower rates.

VA loan borrowers are exempt from certain closing costs, similar underwriting and attorney fees.

Get pre-canonical for a mortgage today.

Conventional Loan 97 for Beginning-Time Home Buyers

The Conventional Loan 97 allows borrowers to secure a conventional loan mortgage with a 3 percent down payment. Personal contribution isn't required. Mortgage gifts, grants, and other DPA can cover your downwards payment.

The Conventional Loan 97 is an culling to FHA loans. It has fewer up-forepart costs and no permanent mortgage insurance requirements.

Borrowers must meet the following criteria to be eligible:

- At least one borrower must be a first-time home buyer

- Mortgages must take a stock-still-charge per unit interest

The Conventional Loan 97 can't be used to buy manufactured homes. Eligible property types include unmarried-family homes upwards to 4 units, condos, and planned developments.

HomeReady Mortgages From Fannie Mae

Statista

HomeReady mortgages from Fannie Mae are another loan option for low-income buyers. Borrowers are eligible with a 3 percent downwardly payment and a credit score of 620 or higher.

Domicile buyer didactics is required if all borrowers are first-time dwelling house buyers. All residents may submit their income for consideration and better chances of approval.

In that location are also no minimum personal contribution requirements for the down payment. This investment can be covered by gifts, grants, and other DPA programs.

HomeReady loans crave mortgage insurance that can be canceled once the heir-apparent reaches 20 percent equity.

Freddie Mac Abode Possible Mortgages

Freddie Mac's Home Possible loans offer low down payment mortgages with a minimum three percent downward payment. Down payment funding is flexible with no personal cash requirements.

A credit score of 660 or higher is required for blessing. Borrowers' income can't exceed 80 percent of the area median income (AMI), which is available on the Freddie Mac site.

Dwelling house Possible mortgages may crave mortgage insurance and buyers can cancel their policy when they accomplish 20 percent equity.

FHA Loans for Buyers With Low Credit Scores

FHA loans have a minimum iii.v percent down payment requirement for borrowers with a credit score of 580 or college. FHA loans have flexible credit score requirements. Borrowers with scores as low as 500 are eligible for approval if they invest a down payment of x pct or more.

FHA loans too require proof of employment and income. Borrowers must take a debt-to-income ratio of 43 percentage or less to qualify under standard guidelines, just FHA may allow ratios up to 56.nine percent with compensating factors.

FHA loans can only be used to purchase a main residence. County-specific loan limits employ, reaching up to $822,375 in high-cost areas.

Learn more nigh getting your FHA loan.

Conventional Loans With 3 Pct Down

Conventional loans are the almost popular loan type among buyers. Standard conventional loans crave a minimum 3 percent downwardly payment with a credit score of 620 or higher.

Conventional loans crave mortgage insurance with a down payment under 20 pct.

Conventional loans aren't backed by the government, and then lender requirements may vary. Befitting conventional loan limits follow FHFA standards. The electric current loan limit is $548,250 for single-unit homes in about U.S. counties.

Frequently Asked Questions From Our Conversation

With the correct loan type, many first-time home buyers tin can buy a business firm with no upwards-front costs. You don't demand to salve a twenty percent down payment.

When y'all buy a house with no money downwardly, y'all can lock in your housing payment long term, protect yourself from rent increases, and y'all can build wealth with a like monthly payment as your rent.

National Mortgage Professional person

What credit score do I need to purchase a house?

Yous tin buy a house with a credit score every bit low as 580, and sometimes lower depending on your lender.

VA and USDA loans have no official minimum, though lenders are almost likely to approve buyers with a credit score of 580 or college.

Conventional loans require a credit score of 620 or higher.

You may all the same qualify for a loan with a credit score below 580. FHA loans accept credit scores every bit low equally 500 if you can make a 10 percent or college down payment.

Learn more about the credit score you demand to buy your home and how to purchase a home with bad credit.

Are there no down payment loans available?

Homebuyer's downwards payment assistance plan, forth with VA and USDA loans, take no down payment requirements for qualification.

Each loan blazon has other eligibility requirements for approving. VA loans are only bachelor to service members and veterans who encounter duty requirements, also as their spouses.

USDA loans can only be used to buy rural properties. This covers 91 percentage of the U.S., including rural areas, pocket-sized towns, and suburbs. This excludes densely populated metropolitan areas.

Larn more about low or no downwardly payment mortgage options.

How can I salvage coin for a down payment?

Down payment assist programs aid showtime-fourth dimension and low-income buyers afford a dwelling. Each program has specific eligibility requirements.

Some loans are flexible and accept downward payments entirely funded through gifts, grants, and loans. Yous may not take to contribute your ain savings. This includes DPA funds and help from family or friends.

Otherwise, the best way to save is with a comfortable upkeep and savings program. Determine which loans you're eligible for and their downward payment requirements to set a goal. Consider how much you can salve each calendar month to determine your dwelling-ownership timeline.

Is private mortgage insurance (PMI) bad?

Mortgage insurance isn't skilful or bad. Lenders may require PMI to protect their investment in instance a borrower can't continue to brand payments. And this protection is what allows lenders to offer so many depression downwards payment mortgage options.

Some loan types crave PMI, and information technology's likewise required for borrowers who make a downwards payment less than 20 percent of the home'due south sale price. Some policies exist for the life of your loan, while others can be canceled once homeowners reach 20 percent disinterestedness.

Homeowners pay PMI upwards-front, with an additional monthly payment, or a combination of the two.

Consider this: Home prices are generally increasing. The boosted monthly PMI payment may be more price-effective than waiting until you have a larger downwards payment.

Consider what loan types yous're eligible for and their mortgage insurance requirements. Anticipate boosted expenses and budget accordingly.

Final Thoughts

Low and no downwards payment mortgages make homeownership accessible for first-time buyers. Know which loans you're eligible for when you lot're thinking about how to buy a firm with no money. Then, get pre-approved for the mortgage of your choice once you're ready to start house hunting.

Happy homebuying.

Get pre-approved for a mortgage today.

Source: https://homebuyer.com/learn/how-to-buy-a-house-with-no-money

Posted by: harveybuind1969.blogspot.com

0 Response to "How Can I Buy A House For The First Time With A Little Bit Of Money Down Payment"

Post a Comment