What Are The Two Primary Pieces Of Legislation That Deal With Money Laundering

It is estimated that betwixt 2–v% of all economic activity worldwide is related to the laundering of proceeds from criminal activities. Trillions of dollars every year are funnelled through innocent-seeming channels to support the operations of terrorists, drug traffickers, prostitution rings, cyber attackers and other unsafe actors.

Money laundering refers to the processes these groups utilize to disguise the origins of their money. Because banks and other financial institutions require clients to disclose how big money was obtained, criminals are forced to hide their sources by funnelling money through legitimate sources in guild to clean their trail. In many cases, they weave elaborate webs of intrigue involving complicated corporate structures, unusual real estate investments or exotic locations in places with minimal law enforcement, known as revenue enhancement havens.

To counter money laundering, financial institutions are required by police force to exist vigilant in detecting potential coin laundering and are field of study to a number of requirements. Many Western countries, including the United States and EU countries, follow the standards prescribed past the Fiscal Action Chore Force (FATF), the global money laundering and terrorist financing watchdog. In this weblog, nosotros'll nowadays an overview of the anti-money laundering (AML) environment in the United States.

What's the police?

The U.s.a. takes money laundering very seriously. The nigh important piece of legislation is the Bank Secrecy Deed (BSA) of 1970, which imposes compliance obligations on banks and financial firms operating within the The states. Among the requirements are conducting Client Due Diligence (CDD) to identify all customers and check that they have viable explanations for their sources of income. Regulated entities must also perform reporting and record-keeping tasks when dealing with suspicious transactions and customers.

The United states Patriot Act of 2001 targets terrorist financing and expands the scope of the BSA by giving police force enforcement additional surveillance and investigatory powers, introducing new screening and CDD measures and imposing increased penalties on firms or individuals involved in terror financing. It too includes specific controls for cross-border transactions.

Other relevant legislation includes:

- Money Laundering Control Human activity (1986)

- Money Laundering Suppression Deed (1994)

- Money Laundering and Financial Crimes Strategy Act (1998)

- Suppression of the Financing of Terrorism Convention Implementation Act (2002)

- Intelligence Reform and Terrorism Prevention Act (2004)

- Anti-Money Laundering Act (2020)

There are 2 main AML regulatory agencies in the United states. The Fiscal Crimes Enforcement Network (FinCEN) is the master AML regulator and operates nether the Treasury Department. It is responsible for combating coin laundering, the financing of terrorism and fiscal criminal offense. The Office of Foreign Assets Control (OFAC) administers The states economical and trade sanctions and works to forestall sanctions targeted countries and individuals from perpetrating fiscal crimes.

In add-on to federal laws, many states have their ain money-laundering provisions that define different penalties for violations.

The Usa is a member of the FATF and follows the FATF Standards to ensure a coordinated global response to forestall organised criminal offense, corruption and terrorism.

What are the requirements for institutions?

All financial institutions are obligated to have AML compliance programs and to report to FinCEN. These include banks and financial holding companies, money services businesses,

securities brokers and dealers, mutual funds, insurance companies, residential mortgage lenders and casinos.

All of these institutions must follow numerous policies requiring them to screen individual clients and transactions and be on the scout for certain kinds of suspicious activity. To this end, they are required to implement the following compliance measures:

- Implementing a clear AML plan outlining policies regarding CDD, transaction screening and systems for screening for sanctions, negative media coverage and PEPs.

- Maintaining records of transactions and reporting to the BSA.

- Appointing a main compliance officer to oversee their house'southward AML program.

- Training employees in AML procedures.

How Companies Screen Clients

Financial institutions must make sure that all clients are properly identified. Client Due Diligence requires all customers to provide identification documents and to develop a basic profile of where their funds come from. Employees must exist trained to identify ruby flags that indicate that something may need further investigation. Red flags practise not indicate suspicion of criminal action, but generally require that a customer provide additional data before approvals tin can exist given.

Examples of cherry-red flags include:

- Customers who provide insufficient or suspicious information

- Customers making efforts to avoid reporting or recordkeeping requirements

- Customers exhibiting a lavish lifestyle that cannot be supported by his or her bacon.

- Fiscal activity inconsistent with the client's business

- Cantankerous-border financial transactions, especially when involving countries with depression AML enforcement

People who present higher risks of money laundering tin be bailiwick to enhanced due diligence requirements, which includes a greater level of scrutiny of potential business partnerships and risks than the regular CDD process. This is applied to clients who have sanctions against them; are loftier net worth; have negative media coverage about them; are involved in unusual or complex transactions; accept links to countries that have sanctions or embargoes against them or are considered loftier-risk jurisdictions; or other similar types of factors.

American laws regarding politically exposed persons (PEPs) are unlike from those in almost other countries. Whereas other nations require enhanced due diligence for whatsoever official with a prominent public role, Us laws require enhanced due diligence for senior foreign political figures just. Being a PEP is just seen every bit a take chances factor to consider when developing a customer adventure profile.

When launderers create complicated corporate structures, with crush companies owned past other shell companies, a large claiming for due diligence can be discovering the ultimate benign owners (UBO) – the people at the top of the concatenation who own stakes of 25% or more of the entity in question. Identifying the UBOs of clients is a requirement of AML laws.

AML Reporting Requirements

Financial institutions must written report whatsoever transaction that involves or aggregates at least $5,000, or $2,000 for money services businesses, and which the financial institution has reason to suspect a transaction. Currency transactions worth more than than $x,000 must likewise exist reported to FinCEN.

Suspicious transaction reports must be submitted to FinCEN if suspicious transactions are detected. These must be submitted no later than 30 calendar days after the appointment of the initial detection. If no suspect is identified, a financial institution may delay filing for an additional thirty days to place a doubtable, only in no case shall reporting be delayed more than 60 days subsequently the date of detection.

Financial institutions must keep all records and reports for at to the lowest degree 5 years to ensure BSA compliance.

It is a criminal offence to engage in a financial transaction if a person conducting the transaction has knowledge the funds were the gain of criminal activity. It is too a crime for employees of financial firms to show deliberate indifference to a client's source of funds. This tin include failing to inquire or investigate cherry flags.

Fines may range from $x,000 per solar day for failures to report foreign financial agency transactions to $100,000 per solar day for failures in client due diligence. Individuals can as well face imprisonment of upwards to 20 years per violation.

For violations that crave firsthand attention, such equally a suspicion of terrorism or an ongoing money-laundering scheme, financial institutions must immediately notify law enforcement by telephone at 1-866-556-3974.

How VinciWorks tin help

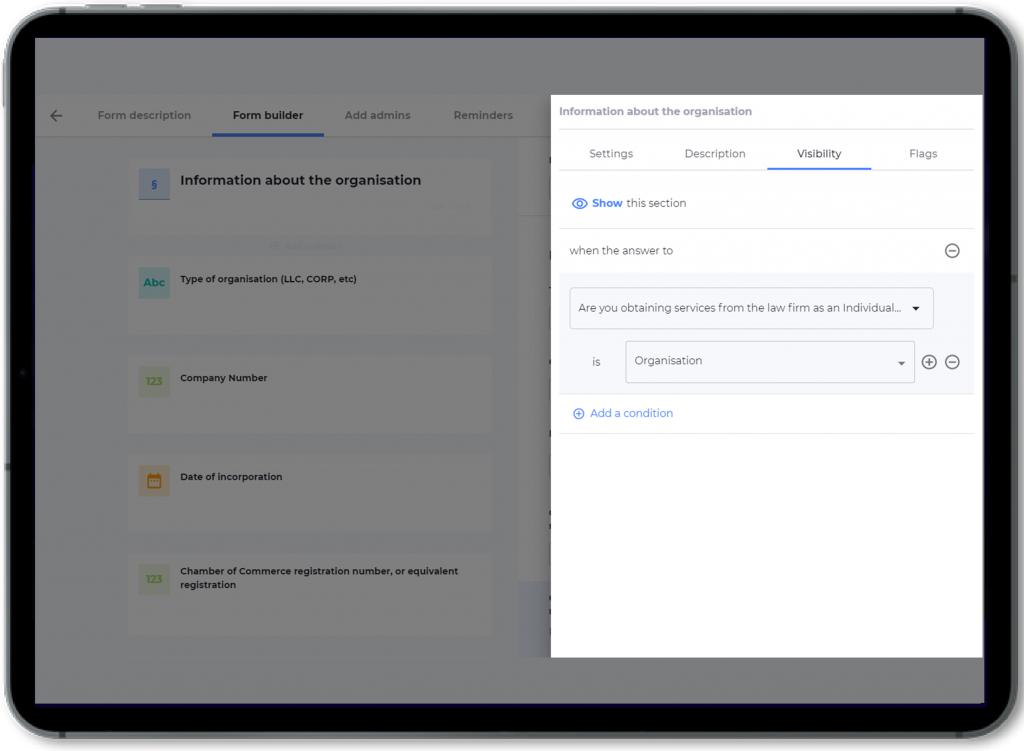

VinciWorks can assist with all of your AML preparation and reporting needs. Our AML onboarding client onboarding solution, which is powered by Omnitrack, enhances both the risk assessment and document collection aspects of client onboarding. Our template workflows adjust to the specific risks posed by each client, based on factors such as jurisdiction, type of entity and industry. This allows you to make informed choices about each customer using the take chances-based approach. Our comprehensive workflows contain industry-specific guidance such every bit JMLSG for FCA-regulated firms and LSAG for law firms. The flexibility of Omnitrack lets you choose the default workflow most appropriate to your business organization. The workflow tin can be customised to suit your ain areas of practice and chance scoring organisation. Our team will guide you through every footstep of the procedure.

We also provide AML training that offers more than simply a tick-box exercise. Our courses are packed with realistic scenarios, existent-life case studies and every customisation choice you tin can think of. Nosotros have everything from in-depth induction training to refresher courses and five-minute knowledge checks.

For more than data, fill out the short course below.

Source: https://vinciworks.com/blog/an-introduction-to-anti-money-laundering-legislation-in-the-united-states/

Posted by: harveybuind1969.blogspot.com

0 Response to "What Are The Two Primary Pieces Of Legislation That Deal With Money Laundering"

Post a Comment